AMERIPEN—American Institute for Packaging and the Environment and the Packaging Machinery Manufacturers Institute (PMMI) soon will be releasing a detailed report intended to help policymakers, consumer packaged goods (CPGs) companies, packaging companies, and other stakeholders adapt to packaging and design developments so they can improve circularity systems nationwide.

In a report titled “Packaging Compass: Evaluating Trends in U.S. Packaging Design,” the two organizations evaluate trends in packaging design and the implications on a circular economy while outlining how coordinated efforts must start now to reach concrete goals over the next 10 years. AMERIPEN represents the U.S. packaging value chain, including material suppliers, packaging manufacturers, brand owners, and end-of-life materials managers, and it is agnostic when it comes to what materials are used in packaging. PMMI is a trade association for the packaging and processing industry.

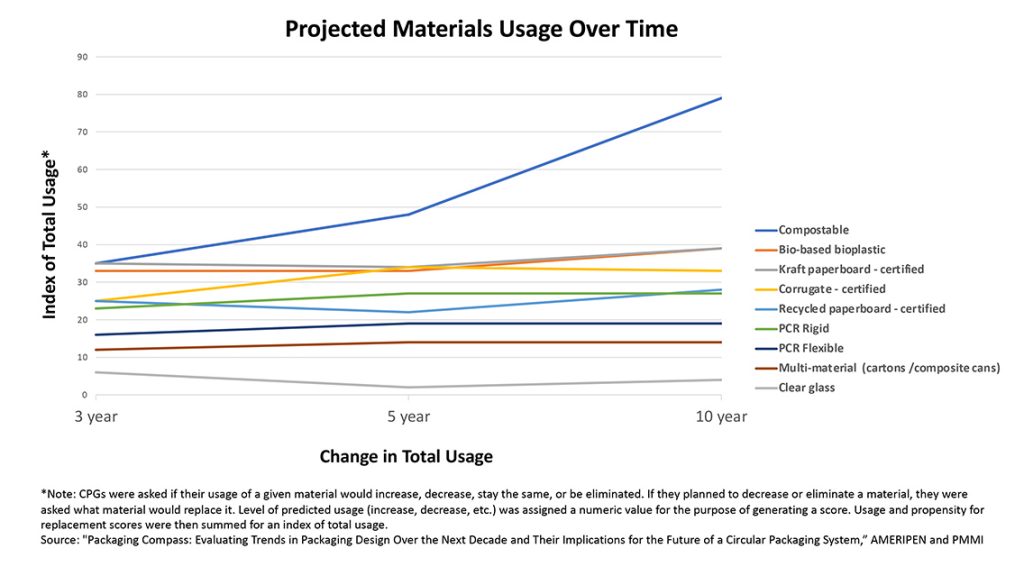

“We wanted to understand what materials are projected to grow or decrease so we could begin proactive discussions with packaging value chain stakeholders on the implications of these trends,” Dan Felton, AMERIPEN executive director, says in an email about the report. “ … One projection from our data is that the use of flexible packaging will continue to grow but that we do not have robust end-of-life strategies currently in place to properly manage that growth. We need to have conversations now on how to improve their recovery and secure legislation that will support this goal.”

PMMI and AMERIPEN say the study examines the projected rates of usage for different materials based on insights from raw material suppliers, converters, brands, retailers, and recovery professionals. It also looks at legislation and what those efforts might mean for compliance demands, design expectations, and investments in recycling and composting systems.

“In the U.S., it takes an average of 10 years to build a new materials recovery facility,” according to a preliminary summary of the report released in January 2023. “Communication between package designers and recyclers can help improve planning to better design systems that work for all.”

Material Shifts

At the core of the report, PMMI and AMERIPEN identify developments in packaging materials in the past few years, including the increasing use of flexible packaging. “While polyethylene terephthalate and aluminum cans retain their lead in terms of growth and market size going into 2025, flexible films upset this pattern because they are growing just as rapidly as cans and faster than many other materials,” according to the summary.

However, just 1.9% of the U.S. public has curbside access to recycling flexible plastics, the study says, citing statistics from The Recycling Partnership. Most post-consumer flexible plastics recovered in the U.S. are collected through retail drop-off programs, but consumer participation in these programs is low.

The study also highlights a high interest in compostable packaging by 2027. Although a small share of the current packaging market, compostable packaging “points to a significant shift in packaging design, material choices, and recovery needs,” the report summary says.

“Yet the promise of compostable packaging is hindered by the lack of composting infrastructure in the U.S. to meet both food and organic waste needs, not to mention compostable packaging,” it says. “ … To realize the potential of compostable packaging, we need to raise consumer access to composting by investing both in increased composting facilities but also in the collection of compostable materials.”

In its survey of various stakeholders, respondents further indicated a strong interest in using more post-consumer recycled (PCR) content in their design processes. However, demand for PCR content far exceeds the available supply. “This indicates that we need to consider what investment is needed to ensure that we can match industry demand for PCR content within packaging,” the summary says.

Government Regulation

To solve some of these issues, states continue to show interest in laws that promote extended producer responsibility (EPR) so packaging producers pay for the costs of recycling or composting their materials. However, investments in recycling infrastructure have not kept up. “Materials that once moved internationally are now increasingly being recovered domestically, but this has also resulted in years of underinvestment and need to ramp up capacity,” the summary says.

EPR funding that is directed toward recovery infrastructure would benefit from input with packaging designers, according to the report. “Based on the trends uncovered, we believe any packaging producer responsibility funding should consider ways to improve the quality and quantity of recycled materials,” the summary says.

Programs should address how to handle hard-to-recycle materials by investing in collection and sortation technology and supporting end-market development while investing in infrastructure to handle compostable packaging.

Universal access to recycling infrastructure should be considered, as well. Recycling or composting may look different in urban and rural communities, the report summary points out. “Ensuring that both have access to a convenient program to collect recyclables, waste, and compostables provides environmental equity,” PMMI and AMERIPEN say. “We should explore effective ways to collect materials from different communities and invest in the necessary infrastructure to do so.”

National coordination and standardization—including creating uniform definitions—would further help meet goals, the summary says, adding that policymakers should avoid moving toward bans. “We caution that bans on materials or packaging formats, while perhaps well intentioned, may have unintended consequences,” the summary says. “With a consistent growth projection anticipated for plastics, and in particular flexible plastics, for example, it may be time to shift the dialogue away from restricting materials to realizing the best way to collect, sort, and reprocess them to reduce environmental impact.”

PMMI and AMERIPEN point out that the various goals require the same element: communication. “By focusing on how best to invest in recovery and recycling infrastructure across the U.S., and by tying that dialogue into what is happening with packaging design and the multiple variables packaging designers must balance, we can create a more effective system,” PMMI and AMERIPEN say. “ … To get to a truly circular packaging system, we need to understand that circularity is not about one process or full recovery, but rather about reducing impacts across the value chain and finding ways to support each other as we seek the balance that will lead to greater success.”

Thomas A. Barstow is the senior editor at FlexPack VOICE®.

SIDEBAR: Key Findings in Packaging Compass report

The results include the following:

- Flexible plastic packaging is popular and is forecast to keep growing. “Flexibles are currently hard to recycle so we need to find ways to manage these materials at end of life,” according to a summary of the report.

- Compostables are a small segment of packaging materials, but growth projections are robust. “The potential of compostables can only be realized, however, if we invest in systems to better collect and compost this packaging format. At the current time, infrastructure for compostable packaging is limited.”

- Companies are placing a greater emphasis on using post-consumer recycled (PCR) content in their packaging. “Demand is anticipated to exceed supply—we must find a way to improve quality and increase supply if we want increased PCR in packaging,” it says.

- Improvements need to be made to recovery processes nationwide, and legislation will be a key driver of this. “We must ensure legislation supports sustainable innovation.”

SOURCE: PMMI and AMERIPEN

SIDEBAR: More About the Report and its Methodology

The goal of the Packaging Compass study was to identify key trends in terms of packaging design for fast-moving consumer goods. The report does not advocate the use of one material over another or measure the sustainable/recyclable properties of different materials. In fact, PMMI and AMERIPEN say they strive to remain neutral concerning materials throughout the report.

“That said, this report reflects the directional trends we heard from survey participants and may not reflect the full breadth of material or packaging formats available,” according to a summary of the report.

“We sought to understand what materials are expected to increase or decrease and what packaging formats may rise to the forefront over the next decade,” AMERIPEN and PMMI say. “In doing so, we wanted to analyze the impact of these changes on the packaging recovery system both in terms of investments into the system but also in terms of the public policy environment that supports our waste management practices.”

PMMI and AMERIPEN analyzed material growth predictions for packaging from various public and private data sources. And they examined third-party research on consumer trends regarding sustainability and sustainable packaging.

In addition, they conducted in-depth qualitative interviews by working with PMMI’s Custom Research group to survey 645 brands and retailers (end users), original equipment manufacturers (OEMs), and materials manufacturers. About 61% of respondents were consumer packaging goods companies (CPGs) or retailers, 20% were materials suppliers or converters, and 19% of respondents were OEMs.

Each group received a specific questionnaire with slightly tailored questions, relevant to their role in the supply chain.

“Additionally, a cross-section of survey participants was selected for a series of interviews to explore their responses in depth,” the summary says. “Interviews were held with CPGs, converters, OEMs, the recycling community, including both re-processors, sortation facilities, and state or municipal recycling officials.”