The transition from a linear to circular economy is so complex observers have found that projects require expertise and investments from multiple stakeholders. And Closed Loop Partners, an investment firm dedicated to a circular economy, is actively seeking applications for projects it can help fund.

“Making flexible packaging more circular is a big challenge, and I think we all realize that,” says Kristin Taylor, director and origination lead for the Closed Loop Infrastructure Group, one of the financing arms under Closed Loop Partners, which provides catalytic capital to companies and municipalities advancing the circular economy. “Only by working together are we going to find the solutions that are going to work for everyone along the value chain.”

Taylor recently led a webinar sponsored by the FlexiblePackaging Association (FPA) and AMERIPEN—American Institute for Packaging and the Environment, a U.S.-based nonprofit that promotes packaging sustainability. Members of both organizations consistently seek solutions that encourage circularity, especially as brand owners increase efforts to improve the sustainability of their packaging.

“We’re investing in this space not only because it’s good for the planet but also because it is a good financial opportunity,” Taylor says. “The circular economy represents a $4.5 trillion global economic opportunity by 2030. It is what makes sense for the planet but also for the bottom line.”

Stakeholders Working Together

Alison Keane, FPA president and CEO, says FPA members should understand they don’t need to go it alone, which is why she wants to get the word out about Closed Loop Partners. The investment firm often forms partnerships with multiple stakeholders who share common goals. That approach, she suggests, is a recipe that needs to be repeated on a nationwide scale.

“One reason we’re partnering with AMERIPEN on this and other initiatives is that we want to get the entire supply chain involved,” Keane says. “And Closed Loop talks to the entire supply chain. They want to put these important partnerships together for investing in recycling, sortation, collection, etc., for all the packaging that we use today. And, of course, we know that flexible packaging is one of the biggest that doesn’t have a home—it doesn’t have an on-ramp to that system.”

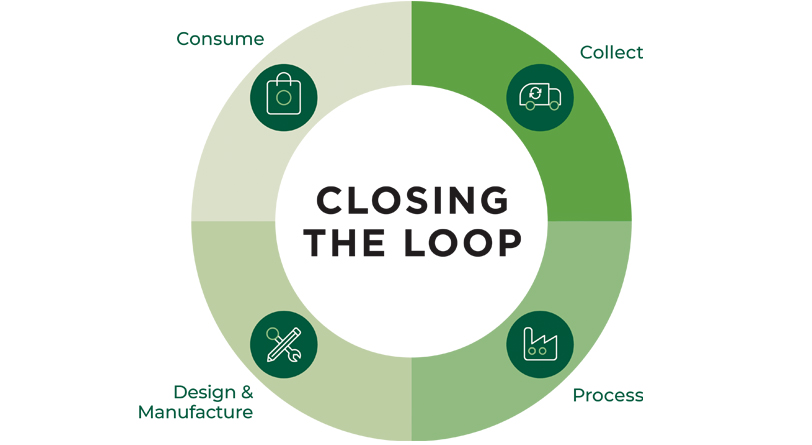

Founded in 2014 in New York, Closed Loop Partners was one of the first investment firms dedicated to building a circular economy, Taylor says. Since then, it has made more than 70 investments in projects that enhance that goal. It has these four primary focus areas:

- Plastics and packaging: The focus is on design innovation, reuse, mechanical recycling, molecular recycling technologies, and other initiatives that can keep materials in circulation at the highest value.

- Supply chain technology: This focus is on using artificial intelligence (AI), data streams, analytic platforms, and predictive approaches that can improve decision-making and transparency.

- Food and agriculture: The focus is on new materials and applications that can prolong the shelf life of food, food recovery systems, composting, and other technologies.

- Fashion and textiles: This focus is on encouraging reuse and resell technologies, material science innovation, and other methods that ensure apparel and textiles can get “a second, third, or infinite lease of life,” according to the investment firm.

The Closed Loop Infrastructure Group primarily provides secured loans, Taylor says, but it can also make opportunistic equity investments. The group’s financing vehicles include the Closed Loop Circular Plastics Fund, Closed Loop Infrastructure Fund, Closed Loop Local Recycling Fund, and Closed Loop Beverage Fund. The typical loan amount is $2 million to $5 million, she adds.

With local recycling projects, for example, a municipality might want to buy modular materials recovery facility (MRF) equipment to increase its collection of polyethylene terephthalate bottles. Through its Closed Loop Local Recycling Fund, Closed Loop Partners can work with the municipality to obtain a lower interest rate and more flexible terms than it could get through traditional lending sources, Taylor says.

“We provide competitive loans to projects to help municipalities buy recycling carts or trucks or to provide an MRF with new equipment that will allow it to either increase capacity or improve the overall quality of key materials,” she says. “These are loans, so we want them to be paid back so that we can recycle that capital, but our goal is really to be catalytic.”“We are supporting projects that really make a difference. It’s not just lip service.”

“We are supporting projects that really make a difference. It’s not just lip service.”

—Kristin Taylor, Director and Origination lead for the Closed Loop infrastructure Group

The Closed Loop Circular Plastics Fund is focused on debt and equity investments to advance the recovery and recycling of polyethylene and polypropylene in the U.S. and Canada. Investors include several FPA members: Dow, Charter Next Generation, and SEE® (Sealed Air Corporation).

“The Closed Loop Circular Plastics Fund is near and dear to my heart,” says Taylor, who is a plastics engineer. “This is a fund supported by some of the largest resin producers and converters in the flexible packaging industry.”

The fund is particularly relevant to FPA members, she adds, “because it is focused on recovery and recycling of films and flexible packaging.”

Project in Minnesota

One notable project became operational late in 2023. As part of the MBOLD coalition’s initiative to build a circular economy for flexible film in the Upper Midwest, coalition members General Mills and Schwan’s Co. invested equity in a recycling and pelletizing facility for flexible films outside Minneapolis. The new Myplas USA facility produces post-consumer resins that can be used to make an array of new film products, including food-grade films, says JoAnne Berkenkamp, MBOLD managing director.

The investor group also included film converter Charter Next Generation, an FPA member based in Wisconsin; MBOLD members Target and Ecolab; and stakeholders from Myplas’ parent company in South Africa, Berkenkamp says.

In addition to the equity investments that totaled about $9 million, much of the other funding for the $24.2 million project came from loans from Closed Loop Partners and The Alliance to End Plastic Waste. The Minnesota Investment Fund and Minnesota Department of Employment and Economic Development also provided grants, Taylor says. Within Closed Loop Partners, the project was financed by the Closed Loop Circular Plastics Fund and Closed Loop Infrastructure Fund; the various funds within the Closed Loop Infrastructure Group can co-invest in projects, Taylor adds.

“It’s very exciting,” she says. The project came about because multiple stakeholders had a shared interest in improving the circular economy. When fully operational and at full capacity, the facility will have the ability to process about 90 million pounds of flexible plastics per year.

New Projects

Such partnerships are critical to seeing through complex projects, observers say. And Closed Loop Partners is actively seeking applications for other projects. “We see a huge opportunity to recover more films,” Taylor says. “We are vetting several opportunities related to films and flexibles in addition to rigid polyethylene and polypropylene packaging. We’re actively looking for creative solutions and ways we can deploy catalytic capital to improve the infrastructure for collection and recycling of these critical materials.”

As companies consider project ideas, Closed Loop Partners can function as a catalyst and a conduit for bringing stakeholders together, Keane points out. She encourages FPA members to explore that aspect of Closed Loop’s services because it is sometimes difficult to see the larger potential for projects if a company is trying to solve a problem alone.

“The idea is to bring that entire supply chain together and those who can help with the solutions and with the investment,” Keane says. “It doesn’t have to be just a filmmaker or just a converter or a papermaker or a brand owner or an MRF or municipal government—they can take some risk but not all the risk.”

Closed Loop can help connect the dots in the initial stages of an idea, she adds. “Closed Loop can help put the pieces together. You can start with half of an idea. And I think it is important for folks to know that you don’t have to have an idea that is fully formulated,” Keane says. “Closed Loop can help you think about it and think about how to interact and then maybe help you put partnerships together.”

Dan Felton, AMERIPEN executive director, notes that states with extended producer responsibility (EPR) laws are in the process of developing details for those programs. California, Oregon, Washington state, and Maine will be available for partnerships to see programs through and find new ways to meet circularity demands, he suggests.

Taylor and Keane agree.

“We think that the EPR states are ripe for investment,” Taylor says. “Investing in recovery infrastructure can help EPR live up to its promise. EPR is going to drive a huge demand for recycled content in the future.”

Seeking Innovations and Connections

Closed Loop Partners also dedicates resources to testing ideas, especially as companies seek innovative ways to deal with new regulations. In some jurisdictions, for example, regulators have been exploring limits on single-use plastics.

“Our innovation center is called the Center for the Circular Economy, where we conduct seminal research,” Taylor says. “We manage precompetitive industry collaborations to solve systems-level problems. For example, we brought together 16 major retailers—including founding partners Target, Walmart, and CVS Health—to advance solutions to address single-use plastic bag waste. We are identifying and testing innovative solutions to reduce single-use plastic bag waste.”

Connections often are made simply because various groups are involved, and they are communicating. Investors, academics, industry partners, and other collaborators are working together to accelerate the transition to a circular economy, Taylor adds.

“For example, our Closed Loop Ventures Group, Closed Loop Partners’ venture capital arm, might be working with a startup that has an innovative new recyclable coating that can replace EVOH (ethylene vinyl alcohol) or nylon. And we can say, ‘Well, we were just talking with this brand owner who is an investor and who is looking to solve problems for films and flexible packaging in this specific space. Let’s make that connection and see if we can pilot this technology,’ ” she says. “Or it could be an AI and sortation technology where we can connect them with one of our MRFs to test and pilot that technology. We’re trying to bring together those supply chain partners to accelerate the innovation.”

She suggests that Closed Loop Partners’ investments have made a considerable impact on the environment. “Through our strategic investments, we have kept 4.8 million tons of material in circulation and have avoided 10.1 million tons of greenhouse gas emissions,” Taylor says. “But alongside the outcomes we have already unlocked is the foundation we are building for long-term impact.”

Its investments in new technologies—across AI, novel chemistries, and supply chain management—have the potential to generate an exponential level of impact, she adds. “We are supporting projects that really make a difference. It’s not just lip service,” Taylor says. “We are obsessed with measuring and communicating our impact, so these types of investments become a model for the future.”

Thomas A. Barstow is senior editor at FlexPack VOICE®.